Cyberattacks are no longer a marginal issue affecting only large corporations with dedicated IT departments. Over the past few years, attackers have increasingly shifted their focus toward small and mid-sized businesses. These attacks are often targeted, frequently automated, and commonly exploit environments where security measures were considered “good enough.” Companies that operate reliably on a day-to-day basis are particularly attractive targets, because attackers know that time, staff, and security budgets are usually limited.

In this situation, cyber insurance appears to be a logical and pragmatic solution for many business owners. Taking out a policy, transferring the risk, and returning attention to core operations seems like a sensible approach. The insurance policy becomes a reassuring safety net running quietly in the background, creating the impression that the company is prepared for a worst-case scenario.

This is precisely where the real danger begins. Cyber insurance does not prevent attacks, it does not eliminate security gaps, and it does not replace effective processes. Instead, it often creates a sense of security that does not hold up when an incident actually occurs. When systems are offline, data is encrypted, and critical decisions must be made under extreme time pressure, it quickly becomes clear that financial coverage and real security are two very different things.

Why Cyber Insurance Is Booming Right Now

Ransomware attacks, data breaches, and targeted fraud have increased strongly in recent years. Many of these attacks are automated and take advantage of common systems and weak security settings. Cybercriminals do not focus only on large corporations. Small and mid-sized businesses are also frequent targets, especially when they have limited security resources.

At the same time, the consequences of cyber incidents have become more visible. Media reports regularly describe encrypted servers, business operations coming to a complete standstill, disrupted supply chains, and ransom demands that force companies to make critical decisions within hours. This constant exposure creates pressure and uncertainty among business owners and executives.

Insurance providers have responded to this growing threat landscape by offering new or expanded cyber insurance policies. These policies promise financial compensation, assistance with incident response, system recovery, and in some cases legal or communication support. In an increasingly complex digital environment, this sounds like a reasonable and responsible step.

For many decision-makers, cyber insurance feels like a protective shield. It creates the sense that the risk has been addressed and that the company is prepared for worst-case scenarios. The idea of “If something happens, we are covered” provides reassurance and allows leaders to refocus on their core business.

From a human point of view, this reaction is easy to understand. Business leaders have to balance risks, costs, and daily business priorities. Problems start when financial coverage is seen as real security. Cyber insurance does not stop attacks, does not remove security weaknesses, and does not replace real protection measures. When these things are mixed up, a feeling of safety can quickly turn into a dangerous illusion.

What Many Companies Don’t Know About Cyber Insurance

The most critical aspect of cyber insurance often becomes clear only after an incident has already occurred: cyber insurance does not pay automatically. Coverage is tied to a wide range of conditions and requirements that many companies either do not fully understand or significantly underestimate.

In practice, this means that a policy may exist on paper, but its actual value depends heavily on how well the company has prepared before an attack. When these expectations are not met, claims can be delayed, reduced, or denied entirely.

Security Requirements Are Not Optional

Most cyber insurance policies require companies to implement basic security measures as a prerequisite for coverage. These typically include regular software updates, effective access controls, secure authentication methods, and reliable, tested backups.

If these safeguards are missing, outdated, or poorly documented, insurers may argue that the company failed to meet its contractual obligations. In such cases, compensation can be reduced or refused altogether. What many business owners overlook is that “having something in place” is often not enough — insurers may expect evidence that security measures are actively maintained and regularly reviewed.

Late or Incorrect Incident Reporting

Another common problem arises from delayed or incorrect incident reporting. Cyber insurance contracts usually specify strict timeframes within which an incident must be reported. If a breach is discovered too late, underestimated internally, or reported with incomplete information, this can quickly lead to disputes during the claims process.

In the chaos following an attack, companies often focus on restoring operations first. However, failing to follow the insurer’s reporting procedures precisely can jeopardize coverage at a critical moment.

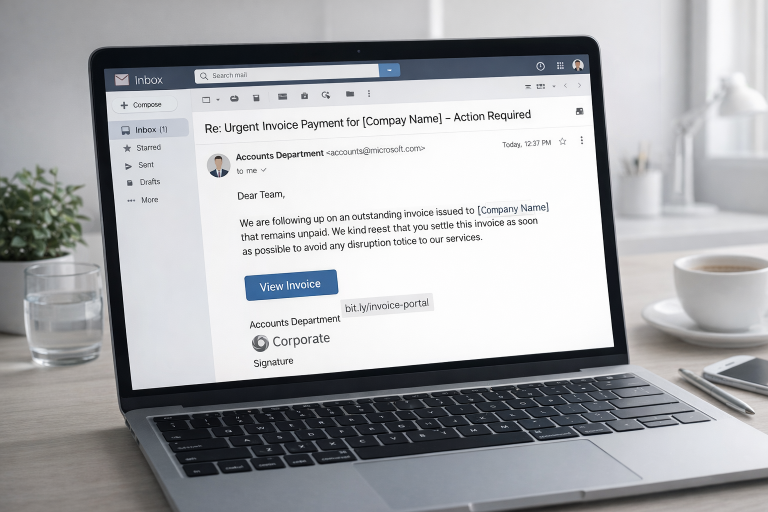

Exclusions for Social Engineering and AI-Driven Phishing

Modern cyberattacks are increasingly sophisticated and convincing. AI-generated emails, fake invoices, deepfake voice calls, and impersonation attacks can easily deceive even experienced employees.

Despite this, many insurance policies classify such incidents as human error or social engineering and exclude them partially or entirely from coverage. As a result, companies may discover too late that one of today’s most common attack vectors is only weakly insured — or not insured at all.

Damages That Cannot Be Insured

Perhaps the most underestimated risk is the impact of damages that cannot be insured at all. Loss of reputation, erosion of customer trust, and long-term business disruption are difficult to quantify and rarely covered by cyber insurance policies.

Even if direct financial losses are compensated, the indirect consequences often remain with the company. Customers may leave, partnerships may suffer, and rebuilding credibility can take months or years.

Financial Coverage Is Not the Same as Real Protection

In reality, a cyber insurance policy does not protect companies from the true consequences of an attack. It merely covers selected financial losses — and only under specific conditions. Prevention, resilience, and operational readiness remain the responsibility of the business itself.

Understanding these limitations is essential. Without this awareness, cyber insurance can easily become a false sense of security rather than a meaningful part of a broader security strategy.

The Greatest Risk: A False Sense of Security

The most problematic effect of cyber insurance is not its existence, but how it is perceived. When insurance is treated as a substitute for real IT security, a dangerous imbalance emerges. Financial coverage begins to replace prevention, and reassurance takes the place of control.

Cyber insurance is often misunderstood as protection against cyberattacks. In reality, it offers compensation after damage has already occurred. This distinction is critical, yet frequently overlooked in day-to-day business decisions.

A useful comparison is an airbag in a car. An airbag can reduce injuries in a crash, but it does not prevent the accident itself. Driving without functioning brakes while relying on an airbag is not a safety strategy — it is a false assumption of protection. The same logic applies to cybersecurity.

Companies that say “We have cyber insurance” often do so with the implicit belief that the major risk has been addressed. As a result, essential preventive measures are postponed, underfunded, or neglected entirely. Patch management, access controls, backup testing, and employee awareness slowly lose priority because the perceived urgency fades.

This mindset unintentionally increases the likelihood of a successful attack. When prevention is weakened and detection is delayed, attackers encounter fewer obstacles, not more. In such cases, the insurance policy does not reduce risk — it indirectly amplifies it by creating complacency.

True security is not about being prepared to pay for damage. It is about reducing the probability and impact of incidents in the first place. Insurance can support this goal, but it cannot replace it.

What Cyber Insurance Does Not Provide

To maintain a realistic perspective, it is essential to understand the limitations of cyber insurance. While a policy may offer financial support after an incident, it does not address the underlying causes or prevent damage from occurring in the first place.

Cyber insurance does not stop attacks from happening. It does not identify vulnerabilities within an organization’s infrastructure, nor does it actively monitor systems for weaknesses. Security gaps remain invisible unless they are deliberately assessed and addressed.

It also does not educate or train employees. Human awareness remains one of the most critical factors in cybersecurity, especially in the context of phishing, social engineering, and AI-driven attacks. No insurance policy can replace informed decision-making by staff members under pressure.

The ability to keep day-to-day operations running is another common misconception. While insurance may help cover recovery costs, it does not automatically restore business operations. Systems do not come back online by themselves, data is not instantly decrypted, and processes are not resumed simply because an insurance policy exists.

Perhaps most importantly, cyber insurance does not protect a company’s reputation. Loss of trust among customers, partners, and stakeholders is difficult to measure and even harder to repair. These long-term consequences are rarely covered and must be managed by the organization itself.

In short, cyber insurance is inherently reactive. It comes into play after damage has occurred. Effective security, however, must be proactive — focused on prevention, preparedness, and resilience long before an incident takes place.

When Cyber Insurance Can Be a Meaningful Addition

Despite all criticism, cyber insurance is not inherently wrong. Under the right conditions, it can be a useful component within a broader security strategy. The key requirement is that it complements existing safeguards rather than attempting to replace them.

A cyber insurance policy can provide real value when fundamental security measures are already in place. This includes properly maintained systems, controlled access to sensitive data, and an overall understanding of where critical assets are located. Insurance works best in environments where security is treated as an ongoing process, not a one-time checkbox.

Regularly tested and verifiable backups are another essential prerequisite. It is not enough to assume that backups exist; they must be restorable under realistic conditions. Without this assurance, even insured companies may face extended downtime and operational disruption that no policy can fully compensate.

Employee awareness also plays a decisive role. When staff members are trained to recognize phishing attempts, fraudulent requests, and unusual behavior, the likelihood of successful attacks decreases significantly. Insurance becomes far more effective when human error is actively addressed rather than ignored.

Clear incident response procedures further strengthen the value of a policy. Companies that know who to contact, what steps to take, and how decisions are made during a security incident are far better positioned to meet insurance requirements and limit damage. Defined responsibilities ensure that confusion does not replace action when time is critical.

In these circumstances, cyber insurance functions as what it should be: a financial safety net. It supports recovery after an incident, but it does not replace accountability, preparation, or leadership responsibility. True security remains a strategic task — insurance merely supports it.

Prevention Is More Effective Than Compensation

Most successful cyberattacks do not rely on highly sophisticated zero-day exploits. Instead, they exploit well-known and preventable weaknesses: weak or reused passwords, missing security updates, untrained employees, or backups that have never been properly tested.

These risks can be significantly reduced, often with a manageable amount of effort. Prevention requires time, structure, and consistent attention, but it is far less costly than operational downtime, data loss, or long-term damage to customer trust.

Cyber insurance may reimburse certain financial losses after an incident. What it cannot restore is lost time, damaged reputation, or the confidence of customers and partners. Once trust is compromised, recovery becomes a slow and uncertain process — regardless of insurance coverage.

True resilience is built before an attack occurs. Companies that invest in prevention gain control, reduce uncertainty, and strengthen their ability to operate under pressure. In the long run, prevention does not just protect systems — it protects the business itself.

Conclusion: Does Cyber Insurance Really Protect your company?

Cyber insurance can help manage financial risk, but it does not protect a company in the way many decision-makers expect. It does not prevent attacks, remove vulnerabilities, or keep normal business operations running. At best, it helps reduce part of the financial damage after an incident has already happened.

Real protection begins long before an incident happens. It is built through clear visibility of risks, consistent security measures, trained employees, tested backups, and defined response processes. These elements reduce both the likelihood and the impact of cyberattacks — something no insurance policy can achieve on its own.

When cyber insurance is treated as a supplement to a well-structured security strategy, it can be valuable. When it is used as a replacement for prevention and responsibility, it creates a dangerous illusion of safety.

The critical question, therefore, is not whether a company has cyber insurance, but whether it has done the work required to deserve real protection. Financial coverage may help recover costs, but only preparedness, prevention, and leadership protect the business itself.

I recommenized you the follow articels

How to Build an IT Security Strategy That Actually Works

How to Build a Simple and Effective Cybersecurity Plan for Your Team

The Ultimate Backup Guide for Small Businesses in 2026

When Outdated IT Becomes a Security Risk – What Your Company Needs to Know

Connect with me on LinkedIn

This is what collaboration looks like

Take a look at my cybersecurity email coaching

And for even more valuable tips, sign up for my newsletter